The beginning of 2020, from a real estate perspective, has been nothing short of sensational. A healthy transaction count and property values firing on all cylinders. Like most resort markets around the world, iridescent sunny blue skies all around us.

However, while Q1 numbers show another strong performing period, this article is broken into two distinctive parts. One of pre Friday, March 13th and one of post March 13th 2020, when sunny blue skies turned, well…

The March Headlines You Want to Know

As I mentioned above, according to media reports, there is a pre and post 03/13/2020 world that appears to be so seismic that March 2020 could be remembered as the transitional moment from the best of times, to the worst of times.

And while sales tell the past, and big closing numbers get all the headlines. It’s every individual new contract that truly forecasts the current and immediate future outlook. Without new contracts, there are no new sales – it is a very cause and effect relationship. A healthy transactional pool keeps the market moving.

With that said, I would like to give some insight into current market conditions by diving into a statistic not generally available to the public, let’s call it — the New Contract Volume (NCV) statistic.

The Explanation: Taking what began on 03/13/2020 called current market conditions and comparing this time to the then (01/01/2020 – 03/12/2020), known as normal market conditions. The goal was to come up with a new contract per day average figure and compare the current conditions with the historical normal.

The Onderko Index (TOI) – Where we are now, compared to where we were then.

The Forecast: The higher the % above the norm, the stronger prices will remain. The lower % or negative % from the norm, the more prices will soften for properties that need to sell in the immediate and near future.

TOI – Somewhat bold, shameless, and fully self-proclaimed, yet valid.

As of 04/07/2020

| Date Range & Region | # Days | # New Contracts | Avg # Contract/Day | |

| 01/01/2020 – 03/12/2020 | 72 | |||

| Maui | 588 | 8.2 | ||

| West Maui | 134 | 1.9 | ||

| Date Range & Region | # Days | # New Contracts | Avg # Contract/Day | % + or – norm |

| 03/13/2020 – 04/07/2020 | 25 | |||

| Maui | 75 | 3.0 | –63% | |

| West Maui | 20 | 0.8 | -57% |

$3M+ Sales

| Date Range & Region | # Days | # New Contracts | Avg # Contract/Day | |

| 01/01/2020 – 03/12/2020 | 72 | |||

| Maui | 18 | 0.3 | ||

| West Maui | 7 | 0.1 | ||

| Date Range & Region | # Days | # New Contracts | Avg # Contract/Day | % + or – norm |

| 03/13/2020 – 04/07/2020 | 25 | |||

| Maui | 7 | 0.3 | 12% | |

| West Maui | 3 | 0.1 | 23% |

*data compiled from Maui MLS

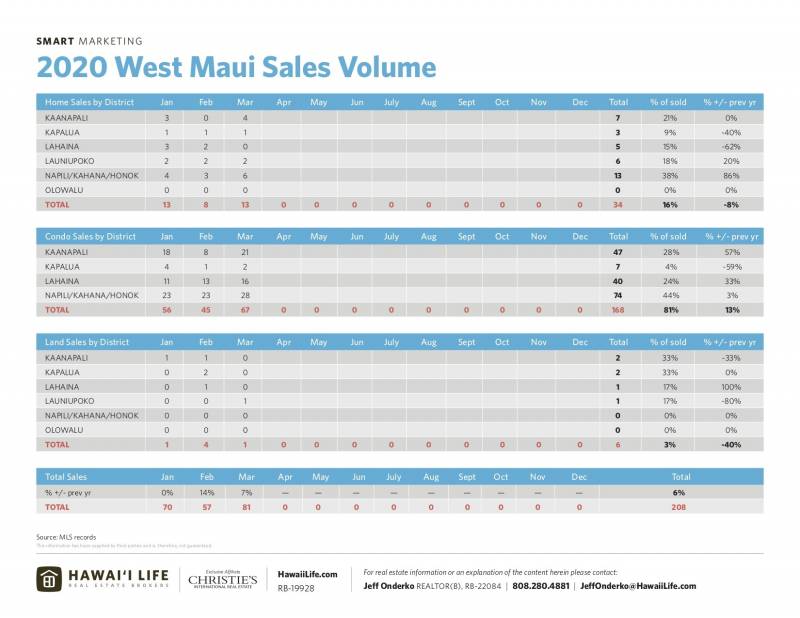

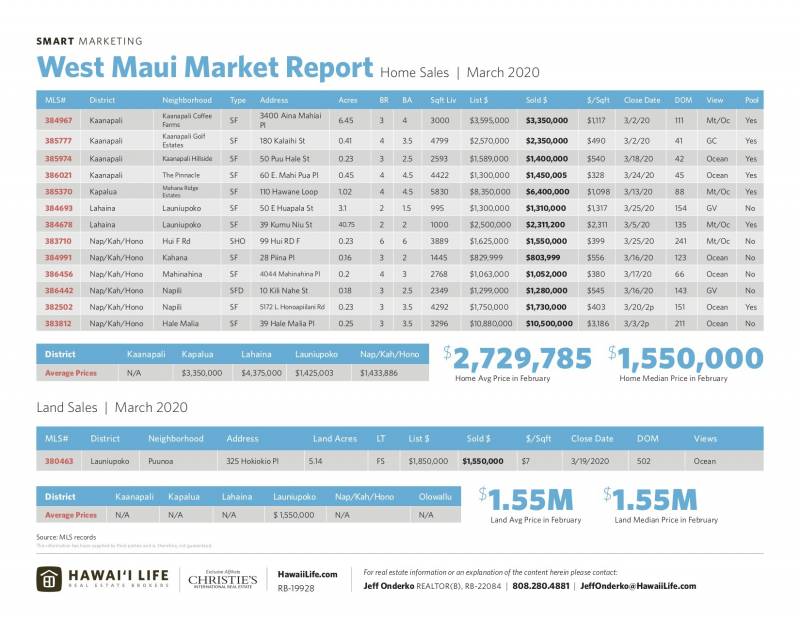

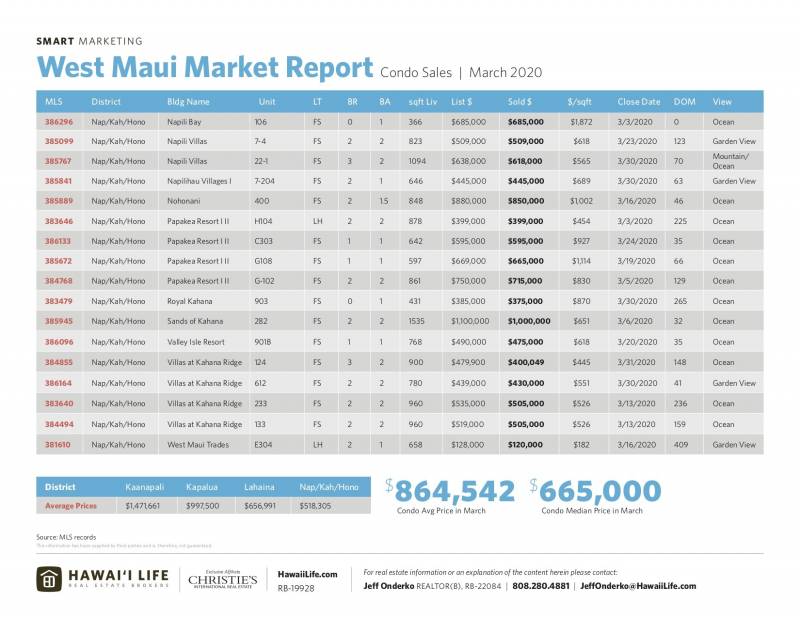

March 2020 & Q1 Headlines

- 80 sales in March | 2nd best monthly total in 10+ years | For comparison the 2019 average sales/month is 65

- 208 transactions for Q1 | +6% over 2019

- Median Sales Prices (+ or – % 2019) Homes $1.425M (+15%), Condos $648K (+11%) & Land $587K (-22%)

- Highest priced sales

- Home – $10.5M in Napili’s Hale Malia neighborhood

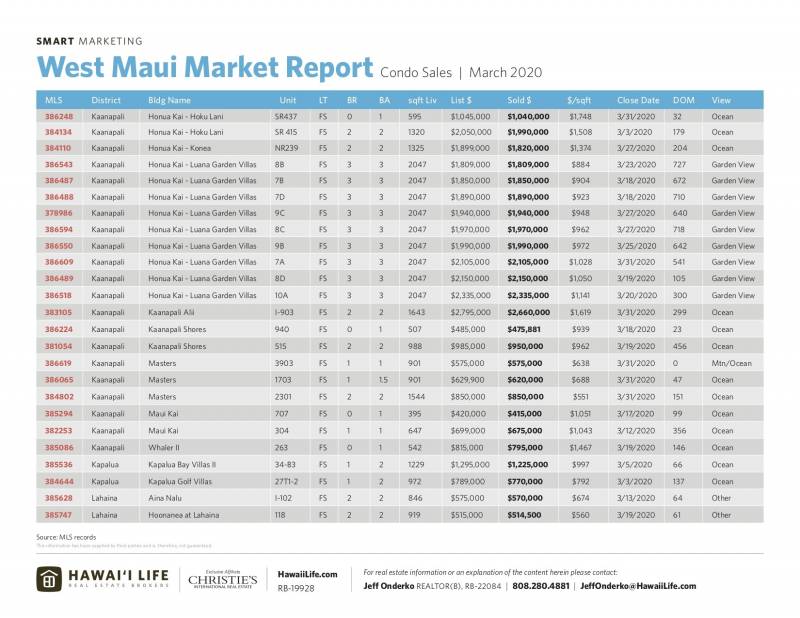

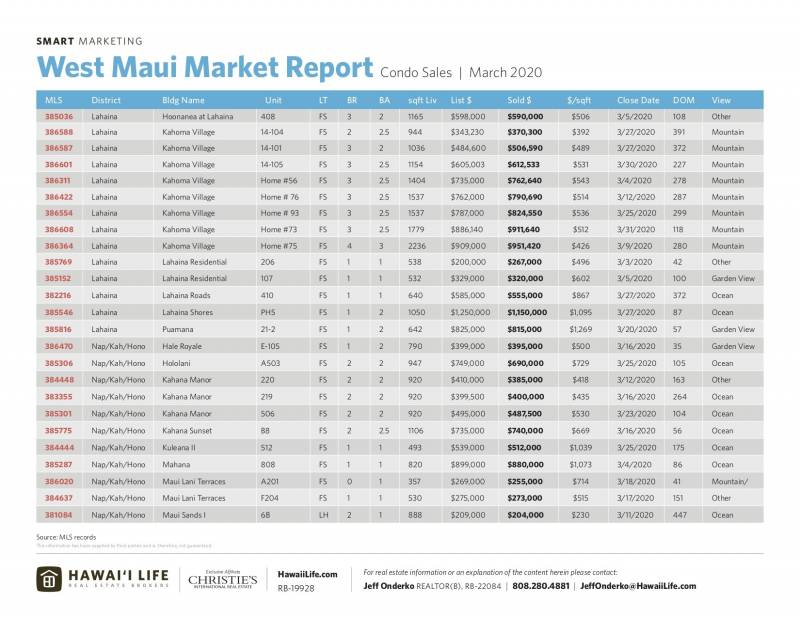

- Condo – $2.7M at the Kaanapali Alii

- Lowest priced sales

- Home – $804K in Kahana’s, Kapau Village neighborhood

- Condo – $273K (FS) at Maui Lani Terraces in <Honokowai

Want to Know More?

The Onderko Index (TOI) will be updated regularly in its own independent format. Pleasesubscribe to my newsletter to receive weekly updates.

If you are in the market for buying or selling West Maui real estate or have any questions about the area or the market in general, please feel free to contact me. I welcome the opportunity to give you information on my previous sales performance and marketing strategies. Or if you’re curious about what your property is worth in today’s market, it would be my pleasure to provide you with property information and a value assessment free of any sales pitch.

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.