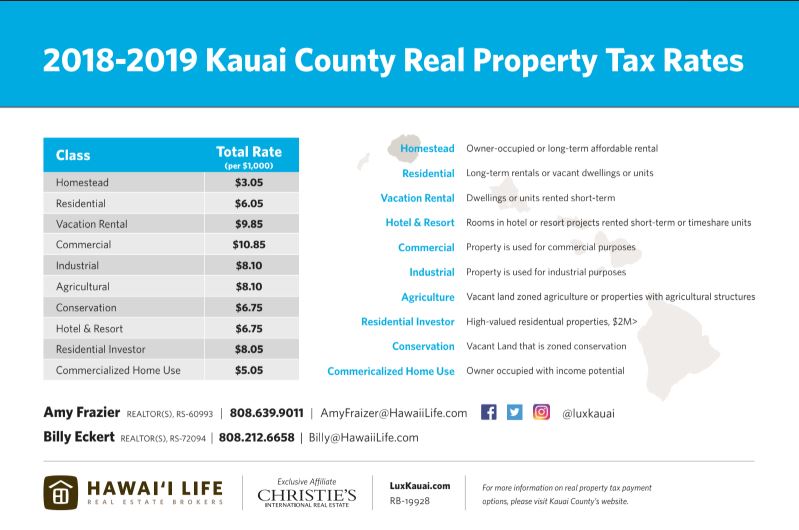

It is important to understand how Kauai assesses your Real Property Tax as well as understanding the different Tax Classifications and dates, which will ultimately set your rate and amount due. The first thing to know is your rate is determined by how you use the property, which sets the Tax Classification and Rate.

The County of Kauai uses these Tax Classifications and Rates x your Assessed Value to = your Property Tax Bill.

The County of Kauai deadline for correcting your tax classification is quickly approaching. Be sure to check your current Tax Classification to double-check that you are in the correct use category as well as be on the lookout for the 2019-2020 Assessments that will be mailed in the near future. Below is a list of important dates to remember.

Important Dates

The fiscal year begins on July 1 and extends until the following June 30. Below are the important dates to remember:

- Sept 30 – Deadline for filing exemption claims and recordation of ownership documents Deadline for applying for additional home exemptions based on income

- Oct 1 – Date of Assessment for upcoming tax year

- Dec 1 – Assessment notices mailed

- Dec 31 – Deadline for assessment appeals

- Jan 20 – Second half year tax bills mailed

- Feb 20 – Second half tax year payments due

- June 20 – Tax Rate set by County Council

- July 1 – Tax year commences Deadline for filing dedication petitions

- July 20 – First half year tax bills mailed

- Aug 20 – First half tax payments due

Each year, Kauai residents make an investment in their County when they pay their real property taxes. Every dollar is returned in the form of vital services we often take for granted. Services such as fire and police protection, civil defense, road maintenance, street lighting, sewer treatment, refuse collection, transportation, maintenance of parks and recreational facilities, housing projects, and elderly services and activities are supported by tax revenue.

While many of these services are partially financed through a variety of other revenue sources including federal and state grants, sewer fees, fuel taxes, motor vehicle weight taxes, transient accommodations taxes, and golf fees, slightly more than 80% of the County’s general fund revenue comes from real property taxes.

How are my Property Taxes Calculated?

The formula for real property tax is:

(Assessed Value – Exemptions) x Tax Rate = Taxes. After the assessment of the property has been made, and any exemptions subtracted from the assessed value, the remaining value is known as the net taxable value. This is the starting point for the calculation of taxes.

How Can We Help?

We believe that our role for our clients extends beyond the sale or purchase of a home, and we strive to have an ongoing relationship with our clients to assist and guide them on all aspects of real estate. We believe that keeping our clients well informed on the current market, county rules and regulations, and well as advising on issues relating to Property Taxes, Property Maintenance, and Improvements, as well as Market Value, all play into our role of offering Full Service to our clients. We see ourselves more as Real Estate advisors rather than a Salesperson on the hunt for the next deal, and we take a real interest in staying up to date on all aspects of Real Property that affect our clients.

If you have questions on your value or other Real Estate related questions feel free to give us a call.

SKGerald

August 8, 2019

Informative, Thanks!

Gerald

February 5, 2021

The Science of Sleep. Resurge is a powerful potent fat burning formula by John Barban, which does not only work for melting off fat, but also regulates the sleep cycle too. In fact, this product only works when a person is in his deep sleep.

https://j.mp/38EuSRk

Jim Ellison

November 16, 2022

How many days out of the year does one have to occupy a home in order to qualify for the Homestead tax rate?

And what exactly is considered a long-term “affordable” rental? Is there a price range?

Thanks for the informative article!