A common question from people considering moving to Maui as well as potential investors is, “What are the property taxes like on Maui?

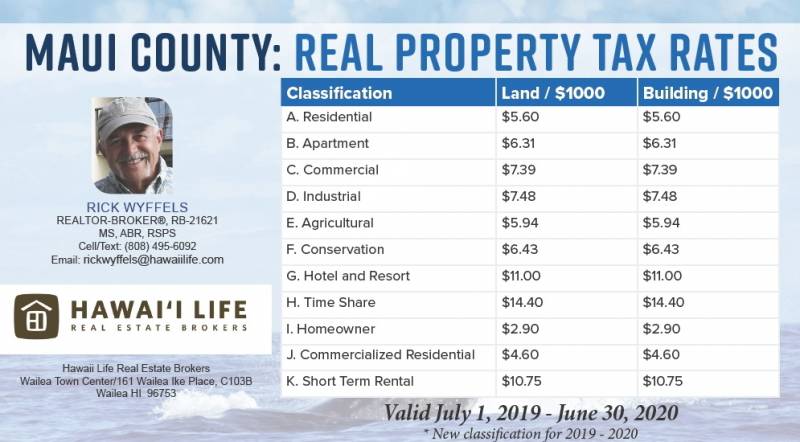

Here on Maui, the taxes are calculated on a “per thousand of assessed value” basis (rather than a percentage basis). In addition, the tax rates are classified on how the property is used, rather than which “tax district” the property is located in.

Short-Term Vacation Rental Property

Let’s say you purchase a property that is approved for Short-Term Rentals. You have decided to use this property as a short-term vacation rental. The short-term rental classification is “K-Short Term Rental,” and the tax rate is $10.75 per thousand. If the property has an assessed value of $650,000, then the taxes would be $650 X $10.75 = $6,987.50 per year, payable twice per year. Due dates are August 20th and February 20th, with each payment being $3,493.75. If you have a mortgage on this property, it is likely the taxes would be escrowed with your mortgage payment at $582.29 per month.

Long-Term Rental Property

Now, let’s examine a scenario where you decide to use this property as a Long-Term Rental (6 month minimum lease). The long-term rental classification is “B-Apartment,” and the tax rate is $6.31 per thousand. If the property has an assessed value of $650,000, then the taxes would be $650 X $6.31 = $4,101.50 per year, payable twice per year. Due dates are August 20th and February 20th, with each payment being $2,050.75 per payment. If you have a mortgage on this property, it is likely the taxes would be escrowed with your mortgage payment at $341.79 per month.

Second Home Property

The next example shows the property being used as a Residential Second Home. Second homes are not rented and are used by the owners and family and friends with no rental income. The second home classification is “A-Residential,” and the tax rate is $5.60 per thousand. If the property has an assessed value of $650,000, then the taxes would be $650 X $5.60 = $3,640.00 per year, payable twice per year. Due dates are August 20th and February 20th, with each payment being $1,820.00 per payment. If you have a mortgage on this property, it is likely the taxes would be escrowed with your mortgage payment at $303.33 per month.

Full-Time Owner Occupied Property

For those looking to live in the property Full-Time/Owner Occupied, the home classification is “I-Homeowner” and the tax rate is $2.90 per thousand. If the property has an assessed value of $650,000, then the taxes would be $650 X $2.90 = $1,885.00 per year, payable twice per year. Due dates are August 20th and February 20th, with each payment being $942.50 per payment. If you have a mortgage on this property, it is likely the taxes would be escrowed with your mortgage payment at $157.08 per month.

But Wait! There’s More!

As an owner-occupant, once you have owned the property for one tax cycle, you are able to apply for a $200,000 exemption on the assessed value of the property. In this case, the home classification is “Homeowner,” and the tax rate is $2.90 per thousand. If the property has an assessed value of $650,000, the exemption changes this value to $450,000. Now, the taxes would be calculated at $450 X $2.90 = $1,305 per year, payable twice per year. Due dates are August 20th and February 20th, with each payment being $652.50 per payment. If you have a mortgage on this property, it is likely the taxes would be escrowed with your mortgage payment at $108.75 per month.

Maui has one of the lowest property tax rates for owner occupants in the United States. An amazing benefit for living in tropical paradise!

These figures are assumed to be correct, but Buyers and Sellers are encouraged to Perform their Own Due Diligence. Information is Not Guaranteed to be Correct.

For more information regarding real estate on Maui, please feel free to contact me!

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.