New Luxury Report Reveals Demand for Hawai’i Real Estate Still Strong Following Pandemic Sales Rush

Hawaii’s Luxury Market Report at a Glance: Historical Market Growth Statewide

Our 2022 Hawai’i Luxury Market Report has just been released and it is full of island-specific infographics and an abundance of real data about what happened in the $3M+ to $10M+ markets so far this year. The new report does compare 2022 with the same period last year, however, it also highlights the importance of taking a long-view perspective on Hawaii’s luxury real estate market. After all, 2021 was an anomaly of a year in all markets, due to the pandemic.

The report suggests that while there has not been any post-pandemic mass sell-off, the “dip” is upon us when it comes to transaction volume. Despite this correction (which bears an uncanny resemblance to a shakeout) Hawaii’s luxury market has had a very strong first half of the year!

For an overview of Hawaii’s luxury real estate market data and insights, notable high-end listings, company performance through the first half of this year, and what we expect for the future, keep reading!

Hawaii’s Luxury Real Estate Market Sees Consistent Growth

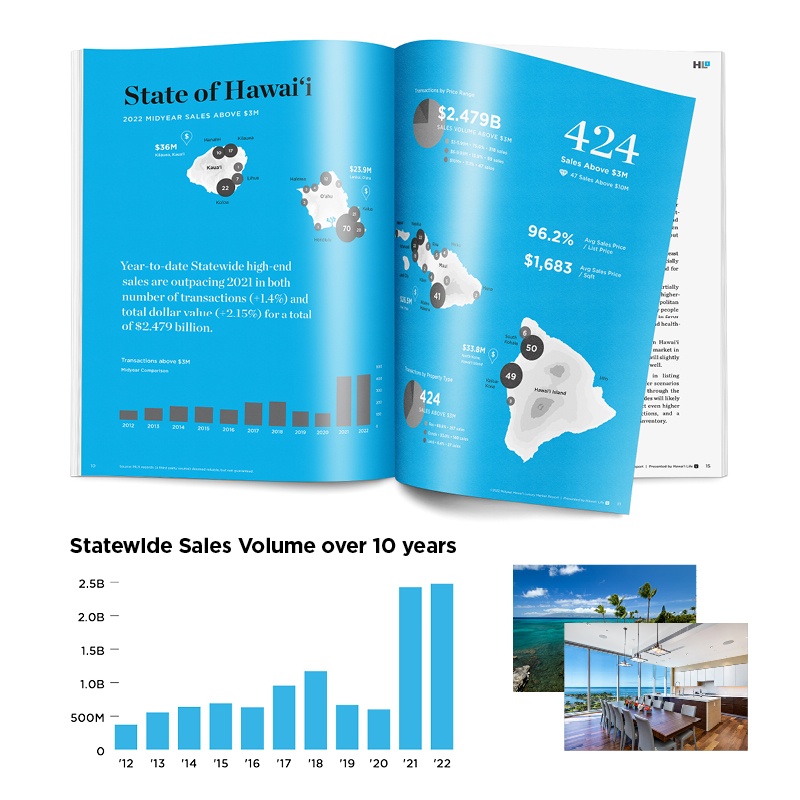

By midyear, the total of 424 sales above $3 million across the state included 318 sales in the $3 million to $5.99 million range, 59 in the $6 million to $9.99 million range, and 47 ultra-luxury sales of over $10 million. And Hawai‘i Life, the top luxury brokerage in the state, still has sales pending in the luxury segment. As for the four major islands, Hawai’i Life represented nearly 12% of all luxury property sales, with $703.8 million in sales of luxury homes. In the first three quarters of the year, demand and appeal in the market remained high.

Driven primarily by new wealth and new high net-worth individuals, we attribute much of this market growth to motivated buyers who view luxury real estate as an asset class. Many buyers converted cryptocurrencies in order to purchase, and most continue to diversify into new business models and flexible working locations that weren’t available previously.

In the first half of 2022, the luxury market (defined as sales above $3 million) has seen consistent growth across the State of Hawai’i, despite the impact that fluctuating interest rates have had on real estate in other markets. In terms of the overall size of the luxury market, Hawaii’s transaction volume experienced an increase of 2.15% over 2021, with sales in all luxury market segments totaling $2.47 billion in 2022.

The ultra-luxury market (for trades at or above $10 million) also saw an increase, from 44 transactions in 2021 to 47 transactions in 2022. The size of Hawaii’s ultra-luxury market grew from $692.59 million in 2021 to more than $782 million in the first three quarters of 2022 alone.

Oʻahu’s Luxury Real Estate Market

In 2021, the vast majority of the luxury market’s growth occurred on the neighbor islands of Kauaʻi, Maui, and Hawaiʻi Island. This year, however, O’ahu’s transaction volume was especially notable. In the first three quarters of 2022, the island surpassed its previous transaction volume and is the only island in the chain to do so this year.

In the luxury segment, O’ahu’s market saw 54.9% growth in the first half of the year. And in the ultra-luxury segment, the island showed a stunning amount of growth. There were 12 transactions above $10 million, versus just 2 in the first half of 2021, which is a 500% increase over last year.

Oʻahu is also the island with Hawaii’s most popular luxury neighborhood, Diamond Head, which racked up a total of 55 sales in the first half of the year. While the most popular luxury neighborhoods on Oʻahu remained in Honolulu, buyers also continued to flock to neighborhoods beyond the city limits. In fact, Hawaii Life’s sales in 2022 have been high and widespread across the island.

The average sold price for luxury real estate on Oʻahu rose 17.66%, from $4.43 million in 2021 to $5.21 million in the first quarter of the year. And a Lanikai estate staked its claim as the highest-priced luxury sale on Oʻahu, selling for $23.8 million. Available for $40 million, the highest-priced listing on Oʻahu is Dillingham Ranch.

By midyear 2022, Oʻahu saw 109 sales at or above $3 to $5.99 million, 16 sales of $6 to $9.99 million, and 12 ultra-luxury sales above $10 million. Of these sales, Hawaiʻi Life represented 15 clients for $82 million by dollar volume in the first half of 2022.

For all of 2021, O’ahu’s luxury condominium market only accounted for 35 sales or 20% of the island’s market above $3 million. As the global markets reopen and as Covid-concerns relax, however, it’s clear that luxury condos are back in favor. In the first half of this year alone, there have been 33 sales of luxury condos, accounting for nearly a quarter of all sales above $3 million.

Kauai’s Luxury Real Estate Market

The Island of Kauaʻi elicited more attention this year, partially due to a trade in Kilauea. Listed and sold by Hawai‘i Life, the $36 million Kauapea Rd. estate was the highest sale in Hawaiʻi. The transaction is one of 57 sales at or above $3 million, for a total of $394.39 million by dollar amount. Carlos Santana also kept the spotlight on Kauaʻi when he sold his Hawaiʻi vacation home for $11.9 million several months after upgrading to a larger property nearby.

Of the 57 total transactions this year, there were 8 condo sales and 4 land sales, while residential sales remained consistent at 45 transactions so far this year. Most of the transactions were centered on Kauaiʻs North Shore, which saw 27 sales. Substantial growth was also evident in Koloa and on the island’s south shore.

Of the four major Hawaiian Islands, Kauaʻi was the leader in terms of the average listing price versus sales price, as well as the average sales price per square foot. Kauaʻi’s home buyers paid an average of 98% of the listing price for their luxury property. And the island’s average sales price per square foot was up from $2,815 in 2021 to $2863 in the first half of 2022.

In terms of transactions above the $10 million mark, the Garden Island saw a total of 9 sales above $10 million by midyear. Considering that this is only one less than the 10 sales in the same period in 2021, it’s safe to say that fluctuations in Kauaʻi’s ultra-luxury market lean toward subtle rather than dramatic.

Given that only 3% of Kauaʻi’s 550-square miles are available for development, housing stock is rare. For the moment, multiple bidders remain common on the island, as does the trend of buyers looking to close quickly.

Maui’s Luxury Real Estate Market

In the first three quarters of 2022, Maui saw 122 sales above $3 million, totaling $737.3 million. And of the four most-populated islands in Hawaiʻi, Maui had the most trades over $10 million, with 15 total transactions in the segment.

Of the 122 trades above $3 million, 63 were residential homes, 50 were condos, and 9 were parcels of land. And the largest parcel of land sold so far this year in the entire state of Hawaiʻi was Kalialinui Estate, a 646-acre lot in Kula that sold for $9.6 million in May.

While the island’s luxury real estate market saw a minimal uptick in inventory, sales prices were also on the rise. Representing an increase of 7.9% from 2021, the average sold price of $6.04 million further bolsters the strength of Maui’s sellers’ market.

The Valley Isle’s luxury market is still riding on a slight sugar high since Jeff Bezos’ $70 million+ purchase in Makena. And the most popular luxury neighborhoods continue to be found in the Wailea-Makena area, with a total of 41 sales from Kihei to Makena Beach. In fact, Maui’s highest sale this year was an estate on Makena Road that sold for $26.49 million.

Another transaction that affirmed Maui as attention-worthy was the sale of professional windsurfer Robby Naish’s estate for $15 million in March. The property set a record for north shore homes and has been featured in The Wall Street Journal, Forbes, The New York Post, and other acclaimed publications.

Hawaiʻi Island’s Luxury Real Estate Market

For the first half of 2022, Hawaiʻi Island saw $633.4 million dollars in total transaction volume in the luxury segment. There were 108 total sales above the $3 million mark, 11 of which were above the $10 million mark. And with the exception of one of these ultra-luxury sales, all were in the private club communities of Hualalai, Kukio, and Kohanaiki.

It’s no surprise that some of Hawaiʻi Life’s highest trades have occurred on Hawaiʻi Island, including a $33.75 million land listing at Kukio’s Kaʻupulehu Beach Club that set a price record for the island and made headlines in The Wall Street Journal. Also garnering media attention was golf legend Vijay Singh’s self-sufficient oceanfront estate on the Hamakua Coast, which is listed for $23 million.

In the first two quarters of the year, the Big Island remained strong, with 47 residential sales and 12 land sales above $3 million. The luxury condominium market also swelled in the first half of the year, with 49 sales compared to 27 sales in the same period in 2021. Factors that fueled this rise in condo sales include a decrease in inventory in the residential space. Specifically, townhomes and detached condos are the primary drivers of this sale increase in the luxury condo sector.

Hawaiʻi Island did experience a dip in transaction numbers in the first quarter. By the second quarter, however, numbers were back up and even eclipsing the same quarter in 2021 by 12.28%.

A market with this much buying intensity is inspiring discriminating buyers. Take Kohanaiki, for instance. Hawaiʻi Life sold a residence in this exclusive Kona Coast community in June of this year after barely being on the market for 1 day. The 450-acre community continues to attract buyers seeking a private club experience, a community built around an 18-hole Rees Jones golf course, and the choice between already-built properties or custom homes they design.

Looking Ahead

In 2022, Hawaiʻi Life significantly outpaced the market’s growth at the high-end, representing more clients in the luxury and ultra-luxury segments than any other firm in the State of Hawaiʻi. Our experience in these segments has enabled Hawaiʻi Life to improve our market share in this coveted space of Hawaiʻi luxury real estate.

As we’ve seen time and again, the luxury real estate market in Hawaiʻi has its own atmosphere. While inventory, interest rates, and absorption rate are consequential, they are hardly as influential on the luxury market here as excellence, quality of life, rarity, value, and other elements that are simply harder to calculate objectively. The luxury market is and will continue to be driven by these less tangible, but consistently powerful qualities.

With international business returning to Hawaiʻi, we expect continued low inventory and short transaction times on Oʻahu, with a respite in intense bidding wars and multiple offers. As we look ahead to the fall and winter, we expect a slight and continued increase in visitors to Hawaiʻi Island, due largely to the lift of pandemic-related travel restrictions and the return of a sense of seasonality in the visitor industry.

Kauaʻi has experienced a period of relative stagnation that may last the rest of the year, save for a few high-profile sales. Based on this market report, we anticipate that the island will continue to hold and set record sales for luxury real estate. In the first half of 2022, Maui was the clear leader in luxury transaction volume, with Hawai‘i Life representing $181.78 million of the island’s luxury real estate volume. As the year progresses, we expect more noteworthy trades, especially in the higher price points, and remain bullish on values of Maui’s luxury real estate.

The first half of 2022 has been defined by an increase in Hawaii’s inventory and demand for luxury homes that is no longer white hot, but still exceeds the available supply. And a remarkable amount of data still points to fundamental economic strength throughout the four most-populated Hawaiian islands.

The Takeaway

The most recent Hawaiʻi Luxury Market Report covers high-end listings, sales, market, and company performance through the second half of this year. Delivering comprehensive market intelligence, the new report is packed with powerful data, analysis, insights, trends, and forecasting.

The most recent Hawaiʻi Luxury Market Report covers high-end listings, sales, market, and company performance through the second half of this year. Delivering comprehensive market intelligence, the new report is packed with powerful data, analysis, insights, trends, and forecasting.

A look back at the data over the past 10 years, reveals that total sales volume has gone up substantially over the past decade and new listings are still coming to market across Hawai’i. And according to the 2022 Hawai’i Luxury Market Report, high-end sales volume is up from $373 million in the first half of 2012 to $2.479 billion in the first half of 2022, representing an impressive increase of 562.88% over the past decade.

For the complete 2022 Luxury Market Report, click here.

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.