Hawaii Market Update – Housing Bottom Has Passed…Mortgage Rate Bottom Too?

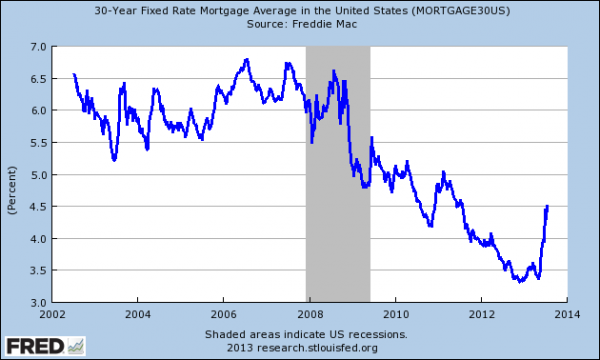

We can look back now in Hawaii and say that the housing market bottomed somewhere in 2011. For some time we’ve expected interest rates to rise as well. Have we seen the last of interest rates in the 3s?

Since 2011 we have seen a gradual rise in prices as inventory continues to diminish. Nationally, according to the National Association of Realtors, the median new home sold for $208,000 in May — a gain of 11% in a year and 21% over two years.

Median prices are now back to their highest level since before Lehman Brothers collapsed. Anecdotally, we’re starting to see price increases on listings that have been on the market a while, where decreases use to be the norm.

Hawaii Interest Rates Increase in 2013

Enter interest rates. With the recent hints by the Fed that they might ease up on their easing, rates have jumped, and it is now quite possible we have seen the last of the 3.something, 30-year fixed rates. And, just as with buying property, everyone wants to buy at the bottom, so with rates, everyone wants the lowest rate.

But even though prices have been slowly rising here on the Big Island, some perspective is in order. Homes and condos may be up 10-15%, but they are still 25-30% below the height of the market, 5-6 years ago. Still a great time to buy, especially with the upside a little clearer.

Similarly, while mortgage rates seem to be moving, they are still historically low, as the chart above shows and it only goes back to 2002. We remember our first home mortgage back in 1980 at over 13%!

Will Higher Interest Rates Slow Down the Housing Market?

We don’t think so, at least not for a while. Rates are still too low, but buyers seriously interested in Hawaii should act and take note of the trends. Sellers certainly are! Bargains are out there if you know where to look. If you’re interested in Kohala Coast property, contact us.

Anthony Sayles, RS

July 27, 2013

Great article Dan

Anthony Sayles, RS

July 27, 2013

Great article Dan