Kauai Real Estate Q2

After a protracted stretch of impressive real estate market metrics, the second quarter of 2022 has finally reflected a changing trajectory driven by rising interest rates and constrained inventory. Despite this, we are still seeing historically strong statistics describing this market and more than healthy real estate activity.

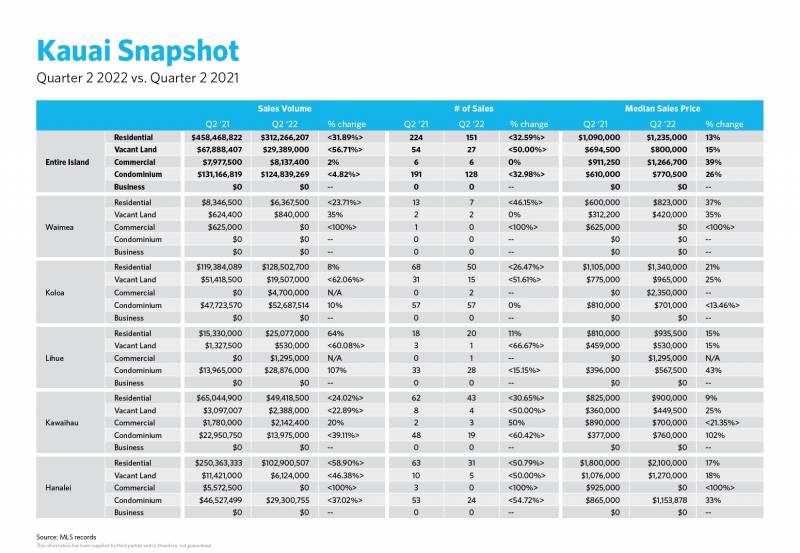

Island wide residential sales volume hit $312.3M during this past quarter, a 31.9% decline from Q2 2021, yet a very strong number nonetheless. Island wide condo sales volume topped $124.8M, only a 4.8% drop from the $131.2M in sales from Q2 2021. The resiliency of the condo sales volume (relative to the larger decline in residential sales) may be a function of the fact that as property values have ballooned over the past year, some buyers have shifted from residential buyers to condo buyers. Island wide residential and condo segments saw significant declines in the number of sales, dropping roughly 32% each year-on-year during Q2. Though values may have lost some steam recently in their relentless rise, Q2 offers an impressive display of appreciation compared to the same period last year, with island wide residential median sales prices up 13% to $1.235M and island wide condo median prices up 26% to $770,500.

The same descriptive statistics are even more pronounced for the North Shore residential and condo markets with larger declines in sales volume and number of sales but larger increases in median sales prices. The North Shore saw residential sales volume of $102.9M in Q2, a year-on-year drop of 58.9%. Similarly, condo sales volume decreased from $46.5M in Q2 2021 to $29.3M in Q2 2022, a 37% decline. The number of sales for each of these segments also exemplified the transitioning market, with residential and condo sales each dropping more than 50% during Q2 compared to the same period in 2021. Lastly, residential median prices for the North Shore rose 17% from $1.8M to $2.1M and condo median prices for the North Shore jumped 33% from $865K to $1.15M during Q2 compared to Q2 ’21.

If you’d like to explore the numbers a bit deeper, check out the market snapshot below for Q2 2022, or via the following links for enlarged versions – Kauai Snapshot Q2 2022

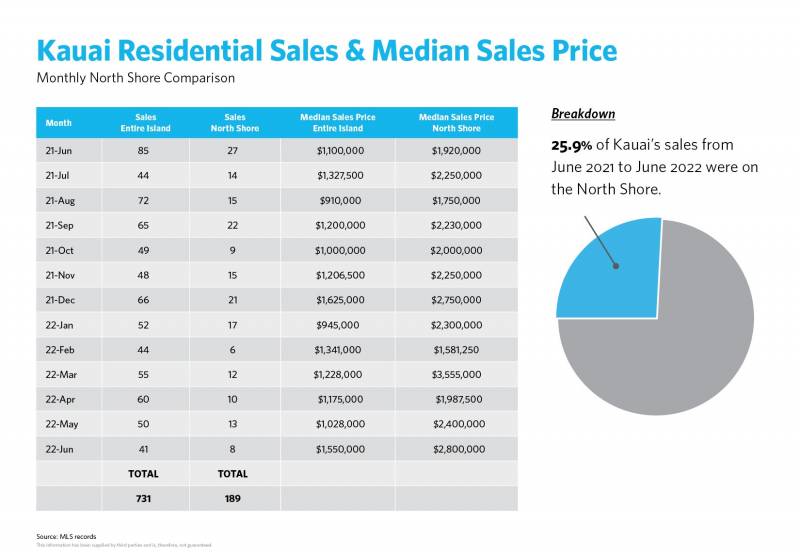

Monthly Sales and Median Price Statistics

The below chart depicts monthly sales and median prices for both the entire island and the North Shore. While median prices continue their trends over the period, one of the biggest stats to jump from this chart is the year on year June comparisons for the number of sales. June 2021 saw 85 island sales versus 41 in 2021 and the North Shore saw 27 sales in June 2021 versus 8 in June 2022.

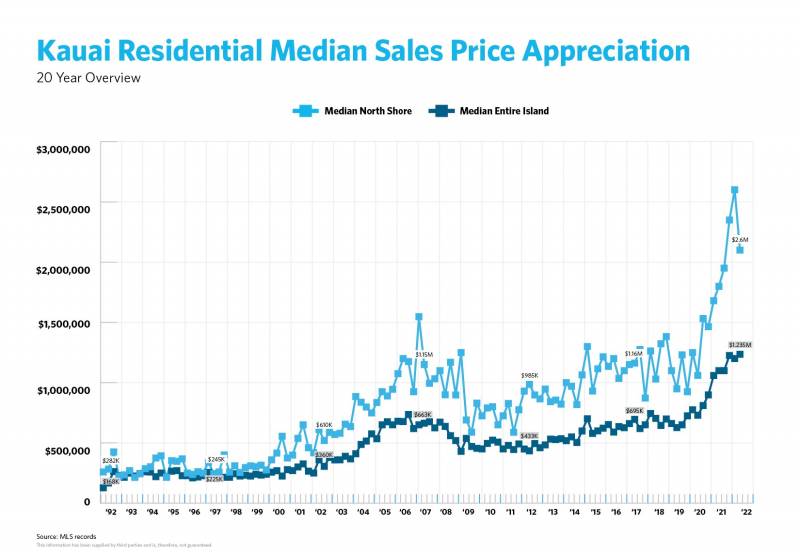

Long Term Quarterly Median Sales Price Trends

This long-term, 30-year overview of quarterly data paints a great picture of the historical appreciation on Kauai. The most current data point shows the first time in many quarters that quarterly median prices did not increase over the prior quarter.

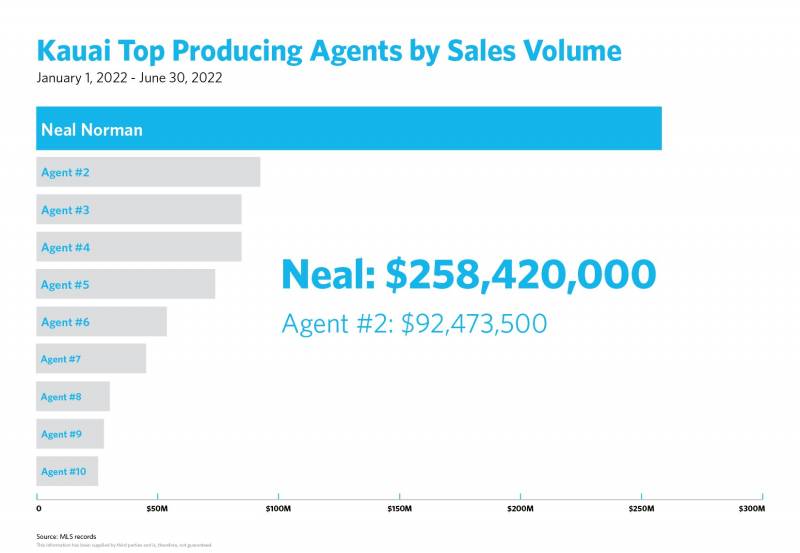

Big Mahalo to our clients for helping us close out our largest first half of the year by sales volume ever. We greatly appreciate your trust in us with your real estate business which propelled us to being #1 in Sales Volume in the State of Hawaii in 2021 and to #29 overall nationwide, according to Real Trends.

Explore more of our beautiful listings at www.nealnorman.com.

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.