Ewa Beach Home Buying: How Low Interest Rates Increase Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.09%, which is still very low in comparison to recent history!

91-2035 Kamakana Street, Ewa Beach, HI. 96705 (sold) $735k

The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.

Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain monthly housing budget.

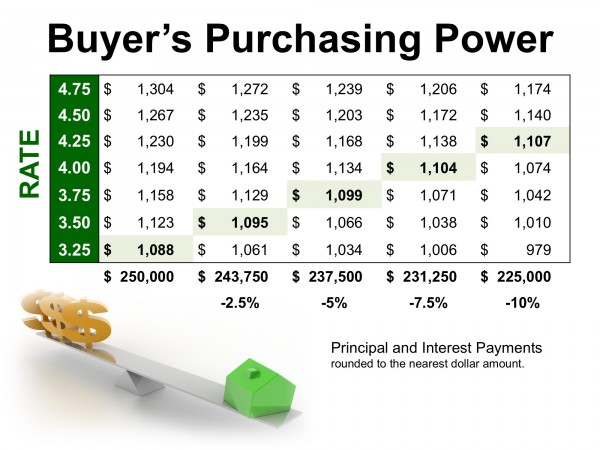

The chart below shows what impact rising interest rates would have if you planned to purchase a home within the national median price range, and planned to keep your principal and interest payments at or about $1,100 a month.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5%, (in this example, $6,250). Experts predict that mortgage rates will be closer to 5% by this time next year.

Act Now to Get the Most House For Your Hard-Earned Money

If you need any information about selling or about buying a home, please contact me.

Aloha for now! See you next time!

MM

P.S. I love my Hoakalei Life and Ewa Beach Life and would love to share with you about it!

Live the dream…Get your Hawaii Life now.

#MMSellsHawaii #MilitarySpecializedTeam

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.