Most professional prognosticators keep saying the current run-up is not a “bubble.” I’ve always learned that a bubble results when:

- prices increase quickly,

- fueled by increased demand,

- which results in a limited supply.

Fueling the Fire

Most definitions also include reference to an economic factor. Theoretically, that’s how this one differs. The only economic factor involved seems to be uber low interest rates. I’m sure you’ve heard that the market is overheated everywhere. If Idaho is hot (for instance) then Hawai`i is “Volcanic” (poor pun I know). Much of our increase is driven not only by those who have learned they can work from home so “why not Hawai`i” coupled by severe lack of inventory.

Low Inventory

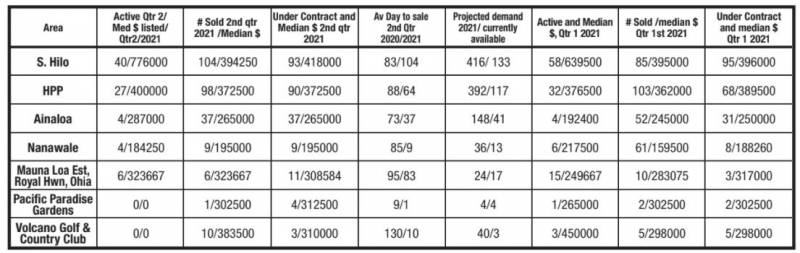

If you look at the chart, there are entire neighborhoods with zero inventory! Builders can’t build fast enough, and even if they could, getting supplies and appliances has become a challenge. Last week, my contractor friend said he could not get insulation which is now required by our building code (why??). Most notable is the increase in values in some of the areas generally regarded as less active. It makes perfect sense that as prices increased in Hilo (check out the current median asking price), buyers gravitated to HPP and now to Ainaloa and Nanawale.

Working From Home

There is one factor that may change this demand a bit. Some workers who assumed they would be able to work from home forever are now being told to report to the office. We have already had escrows, and buying trips cancel. Given the employee shortage, it will be interesting to see if this trend reverses as employers seek to retain and rehire employees. We do expect an increase in inventory as restrictions are lifted. Many delayed marketing their homes because there was no place to go during Covid.

Days on Market

Days on market (DOM) is always a strong indicator of market direction. Although DOM has increased in a few areas, low inventory levels will continue to fuel the market. I’ve been asked why my team insists on detailed preparation of homes prior to listing in such a brisk market.

Setting the Stage

Take staging, for instance. A recent article in AARP estimates that staging increases value between 6-10%. The average seller cost to stage is about $2,000 per month. For this reason and because it causes our listings to sell faster, we cover that expense. I feel it’s always best to get the property completely ready. Not doing so is a gamble I’m not willing to take. As I always say, if a seller won’t get the property ready, then someone else should list it. Make sense??

Year-to-date increases island-wide show a 46% increase in sales numbers and about 20% increase in price. Time will tell if we are getting back to normal but for now, expect to see prices continue to inch up as inventory continues to stagnate!

Don’t see your neighborhood here? Just contact any member of Team Nakanishi, and we’ll set you up for complete and tailored information for any property on Hawai`i Island!

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.