But for the constant political drama, I’m convinced we’d again be hearing more about what Freddie Mac is predicting will be a “Golden Year” in housing**.

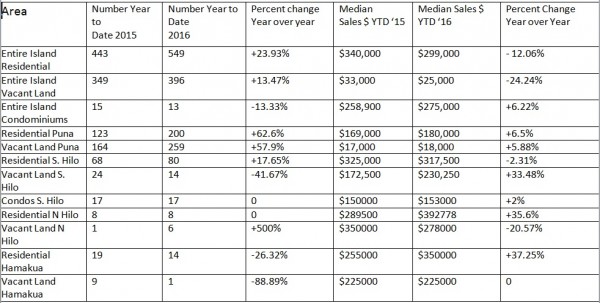

Island-Wide Sales Statistics for the First Quarter This Year

Statistical data courtesy of Hawaii Information Service, the best MLS system ever!

In fact, 2016 is predicted to be the best year since 2006, which as you may recall, was the year home prices and activity hit an all-time high. That’s huge!

Home prices nationwide increased about 6% in 2015. Expectations are a bit more modest this year, but the market is certainly more active in most segments. Momentum is expected to continue through 2017.

When you look closely at the chart, you’ll notice island-wide residential pricing actually decreased, yet prices in most of East Hawaii increased. This means that West Hawaii (including Ka’u) is pulling island-wide statistics down.

Puna & Hilo Residential Sales Activity is Up…Way Up!

Condos in Hilo are still a bit undervalued in my opinion. I am told that the condo market in the resort areas (Kohala) is also very soft. Oceanfront homes in Puna offer another great opportunity. These are probably among the best oceanfront values in the state.

Mealoha and I recently returned from the mainland. We saw cranes and construction everywhere. In Miami alone, there are about 138 new high-rise buildings under construction. Likewise, at home, we haven’t experienced the current level of construction activity in years.

Although there was a quarterly sales pricing decrease, I don’t think the trend is going to continue. With 549 homes changing hands in the first 3 months of the year, we are certainly seeing our fair share of sales. In fact, comparing March 2015 sales to March 2016, there was actually a 37% increase in residential sales island-wide.

Puna residential sales were up a whopping 74% and Hilo sales numbers were up 40%. Even new construction can’t keep pace with that demand. Lower supply and consistent demand means higher pricing will follow.

Fence sitters should get off the fence and act while interest rates and supply are still good. Interest rates to remain low through at least the first half of the year and probably until the elections. After that, we shall see!

**Realtor Mag Apr 1, 2016.

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.