Elama series 35.20 Series at Hoakalei

Some Highlights

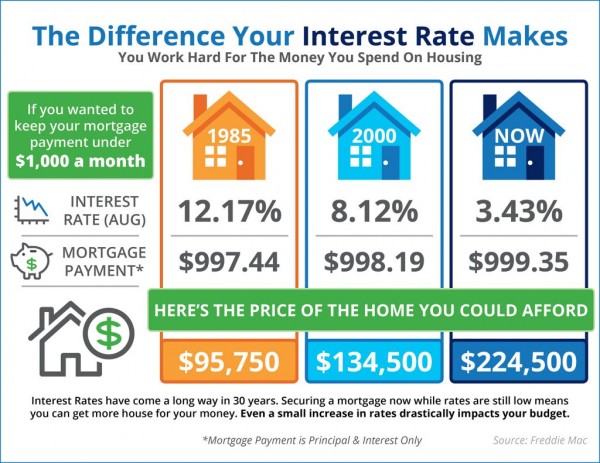

- Interest rates have come a long way in the last 30 years.

- The interest rate you secure directly impacts your monthly payment and the amount of house that you can afford if you plan to stay within a certain budget.

- Interest rates are at their lowest in years…right now!

- If buying your first home, or moving up to the home of your dreams is in your future, now may be the time to act!

Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have started to inch up, most experts predict that they will begin to rise even more over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac, and the National Association of Realtors are in unison projecting that rates will be up approximately three quarters of a percentage point over the next 12 months.

An increase in rates will impact your monthly mortgage payment. Your housing expense will be more a year from now if a mortgage is necessary to purchase your next home.

Either Way You are Paying a Mortgage

As a recent paper from the Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does – as Americans intuit – end up making more financial sense than renting.”

View from 35.10 Series at Hoakalei

More Information

If you need any information about selling or about buying a home, please contact me.

Aloha for now! See you next time!

MM

P.S. I love my Hoakalei life!

Live the dream…Get your Hawaii Life now.

#MMSellsHawaii

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.