5 Tips to Avoid “Buyer Fatigue” in Maui’s Competitive Real Estate Market

Buyer fatigue? It’s a real thing! Especially on Maui where the trifecta of low inventory, low finance interest rates, and the ability to work remotely have led to a buying frenzy. Prior to the Covid-19 pandemic, many Buyers waited to retire to purchase property in Hawaii. Many parents waited for their children to graduate college to become empty-nesters. A widespread “Carpe Diem” mentality, the ability to live and work in paradise, and low interest rates are the perfect combination for more Buyers to pull the Property-Purchase trigger much sooner than they originally planned. The result is a low supply, high demand Seller market that frustrated and fatigued Buyers are currently experiencing on Maui.

In this fast real estate market, it is important that I position and prepare my Buyer clients in advance so they can have realistic expectations around timing, an offer price, and negotiations that will enable their offer to stand out from the pile of multiple offers.

I share these five tips to avoid Buyer Fatigue with my clients, so they are prepared when a new listing they like goes pending into escrow the very next day it hits the market, or if their offer gets rejected in a multiple offer situation.

1. Act Fast

Timing is everything. Be ready to act fast to view a property and to submit an offer. Most recent new listings on Maui have an accepted offer within the first four days of coming on to the market. Check for new listings and price adjustments every few hours, at least daily, and request to view the property as soon as possible. Some Sellers disclose an offer review date which helps eliminate the first-come, first-serve competition to submit the first offer. But be prepared to clear your schedule and be flexible so you can view a new listing as soon as it comes on the market.

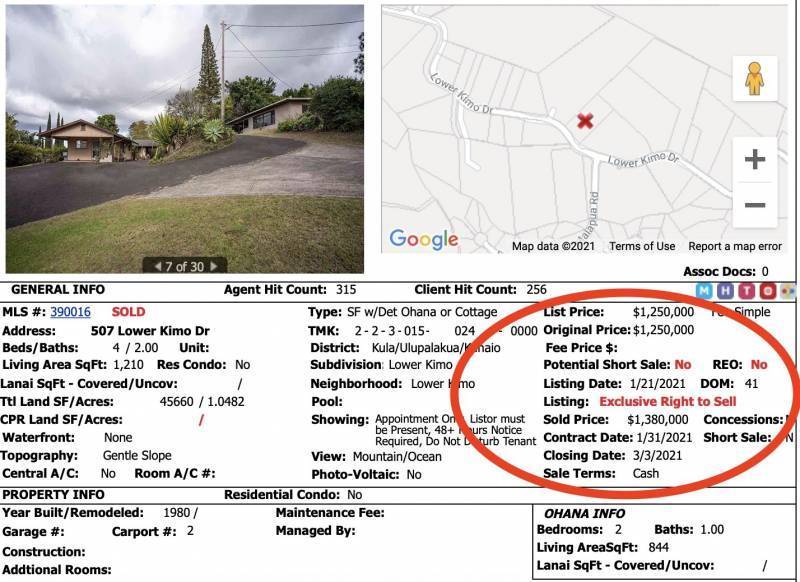

An example of a recent listing in Kula that sold on March 3, 2021 and received multiple offers. It sold for $130,000 over list price with an all cash offer that went into contract 10 days from the list date.

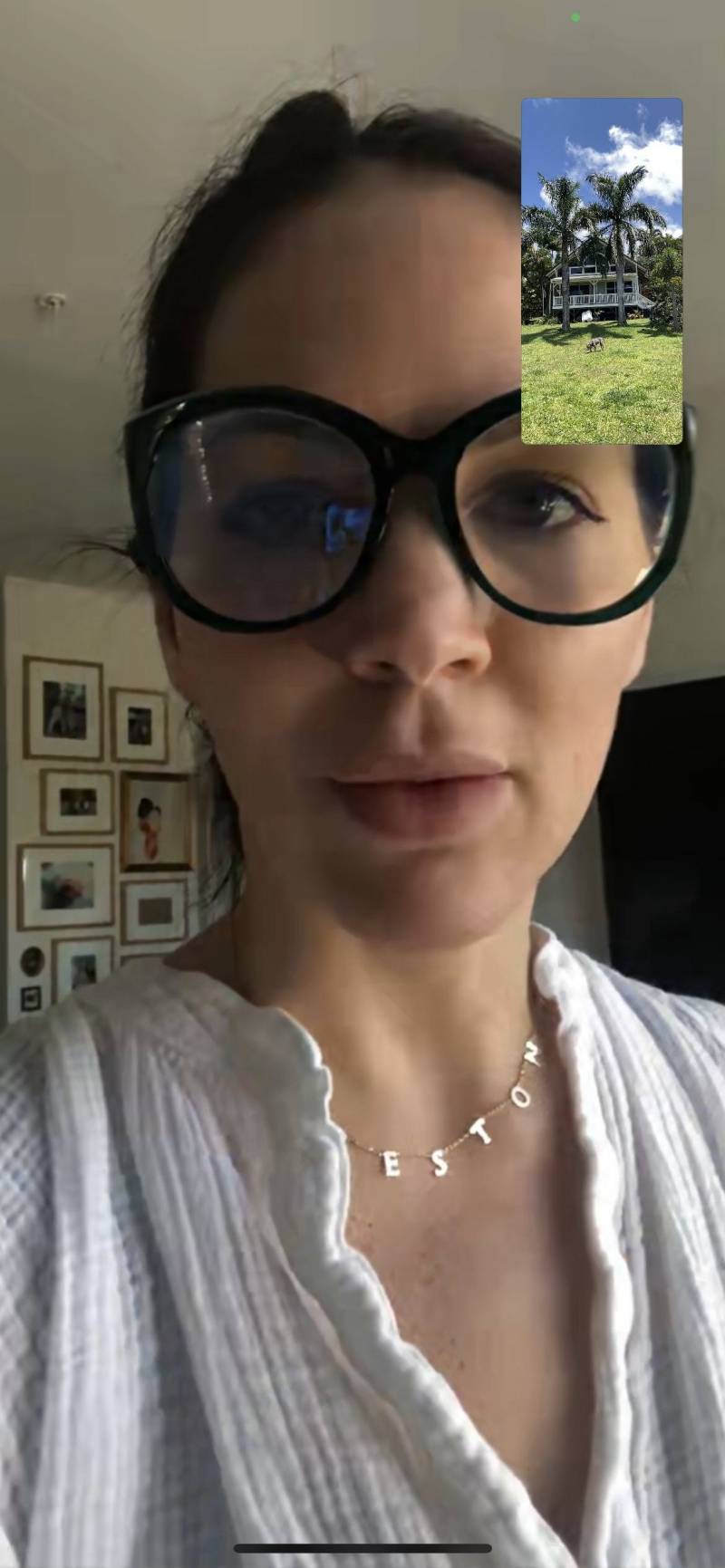

2. Virtual Tours = Site Unseen Offers

Be prepared to make a Site Unseen Offer. Facetime and Zoom property tours are the new norm for showing property. I request virtual tours as soon as I see a property hit the market for my Buyers so they can tour the property during working hours and schedule an in-person showing as soon as they are available. Oftentimes, this leads to offers that are submitted Site Unseen. Once an offer has been accepted, off-island Buyers can use the Buyer Inspection period to visit the property in person.

3. Get Preapproval

Before moving forward with an offer that requires financing, Sellers want to know exactly how preapproved a Buyer is. To get preapproval, you complete an initial loan application. The lender then does an extensive check on your finances and credit record. If everything checks out, the lender will state the exact amount they are willing to loan you so long as you meet certain conditions and the home meets certain requirements of the lender. The preapproval is good for a set amount of time, usually 60-90 days.

Be prepared to show a preapproval letter from a reputable local lender prior to viewing listings. Most Sellers want to only consider Buyers that are ready and able to purchase their property immediately and will require a preapproval letter prior to scheduling a showing appointment. A financing Buyer’s offer that includes a preapproval letter helps stand out from multiple offers.

4. Submit Your Best Offer

A property is worth what someone is willing to pay. I keep my clients informed with Maui market updates so they can set realistic expectations when submitting an offer. The average sales price of Single Family Homes in February 2021 was $1,824,061. This is an 86.8% increase since February 2020, prior to the start of Covid-19. The number of new listings in February 2021 was down 17.9% compared to February 2020, which indicates a substantial decrease in inventory. Most recent property sales on Maui closed at or over asking price and received multiple offers. This Seller market commands your best offer price from the start. Do not expect a Seller to counter offer. Sometimes a Seller will come back to Buyers in a Multiple Offer situation and request their “best and highest offer,” but I am seeing more and more Sellers select their top two offers to negotiate with and rejecting the remaining offers.

5. Submit a Back-Up Offer

It is always worth submitting a backup offer for a property that you love that already has an accepted offer in place. You just never know what type of change in familial, health, and work circumstances can cause a Buyer to cancel a purchase. As a Buyer in the first back-up position, your offer would come into play once the original Buyer has canceled. An accepted backup offer secures your Backup Buyer position and avoids another multiple offer situation and possible bidding war.

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.